Bank Statement Loans for Self-Employed Borrowers

For self-employed borrowers it can sometimes be difficult to qualify for a mortgage. They typically don’t have the traditional income documents like pay stubs and W2s. Self-employed wage earners can write off business expenses from their gross income, which allows them to pay less in income taxes, but they have the means to buy a home that is more than what they would be traditionally qualified for.

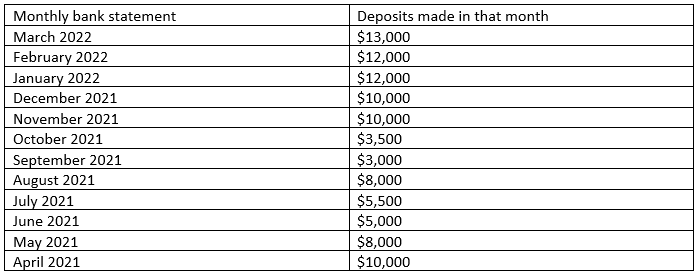

Verify your mortgage eligibility (Mar 7th, 2026)One loan program for self-employed wage earners is a bank statement loan. Income tax returns are not required, and qualified income is calculated by averaging the past 12 months of bank statement deposits. Borrowers have the option to use personal and/or business bank statements.

Example:

Total deposits made in the last 12 months = $100,000

Verify your mortgage eligibility (Mar 7th, 2026)Divide by 12 months = $8,333.33 estimated qualified monthly income

Keep in mind that some lenders may have additional guidelines to qualify for bank statements loans. Some may require…

-

3 established credit tradelines

Verify your mortgage eligibility (Mar 7th, 2026) -

Verification of rent or past housing payment history

-

Strict debt to income ratios

-

A higher down payment is required (10% to 30%) – see the example below

Verify your mortgage eligibility (Mar 7th, 2026) -

24 months of bank statements

Not all deposits will count towards qualified income and lenders will also apply an expense ratio. Underwriters will exclude credit returns, account transfers, and credit card advances. Borrowers can only use 12 months of bank statements from one bank. Also, the down payment required may be dependent on the borrowers’ credit scores.

For example:

Verify your mortgage eligibility (Mar 7th, 2026)620 FICO may require a 20% down

720 FICO may require a 10% down

If you are a self-employed business owner and have been in business for at least two years, you should consider getting pre-approved for a bank statement loan program. This option is available for primary, second/vacation homes, and even investment properties.