Your Guide to Buying Your First Home: The California Dream for All

Welcome future homeowners! If you’ve ever dreamt of having a place to call your own, this is for you. Today, we’re unraveling the ins and outs of the California Dream for All Conventional First program, designed especially for first-time homebuyers. We know the process might seem overwhelming but fear not – we’re here to break it down for you in a way that’s easy to understand.

Verify your mortgage eligibility (Jul 27th, 2024)

Down Payment and Closing Costs:

It’s important to note that the CalHFA Dream for All program’s down payment and closing costs assistance are capped at $150,000.

This money can be incredibly valuable, covering your down payment and closing costs making homeownership more achievable. However, there are exceptions. For instance, deciding to contribute more towards the down payment could affect your loan amount, as discussed in more detail below.

Verify your mortgage eligibility (Jul 27th, 2024)

Voucher and Randomized Drawing:

In April 2024, CalHFA will allow pre-approved homebuyers to enter a random drawing. The drawing will be open for 25-30 days, and then CalHFA will select registrants for a voucher. This will not be first come, first served.

**UPDATE AS OF MARCH 2024**

Verify your mortgage eligibility (Jul 27th, 2024)The Registration Portal will open April 3, 2024, at 8:00 am PDT and close April 29, 2024, at 5:00 pm PDT

Pre-approval Process:

Picture this as the first step towards your dream home. During pre-approval, we run a soft credit pull (this does not affect your credit) and review your income and asset documents to determine how much you would qualify for. Keep your credit, debt-to-income ratio, and income within guidelines until the file is closed. Remember, any changes in credit or income may affect your eligibility.

Verify your mortgage eligibility (Jul 27th, 2024)

Income Limits:

Stay within the income limits specified by the California Dream for All program. The income limits can vary depending on the county where you plan to buy your home.

2024 California Dream For All Shared Appreciation Loan Program Income Limits

Verify your mortgage eligibility (Jul 27th, 2024)

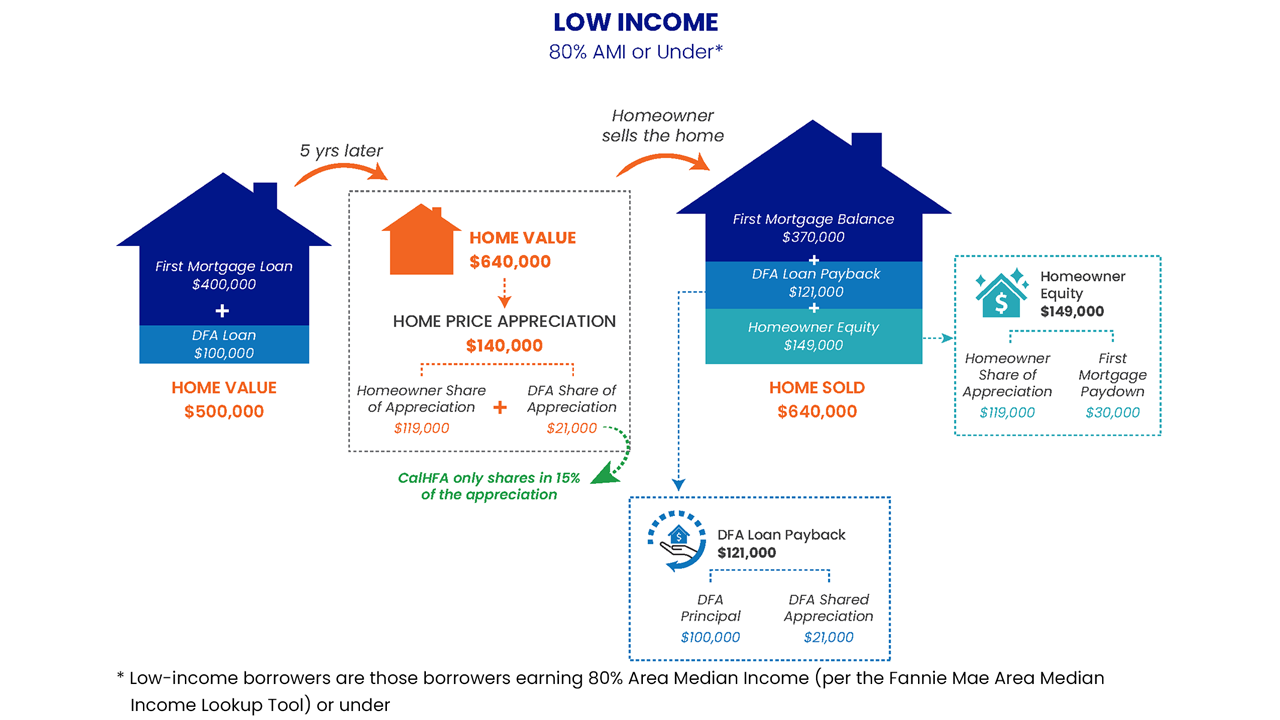

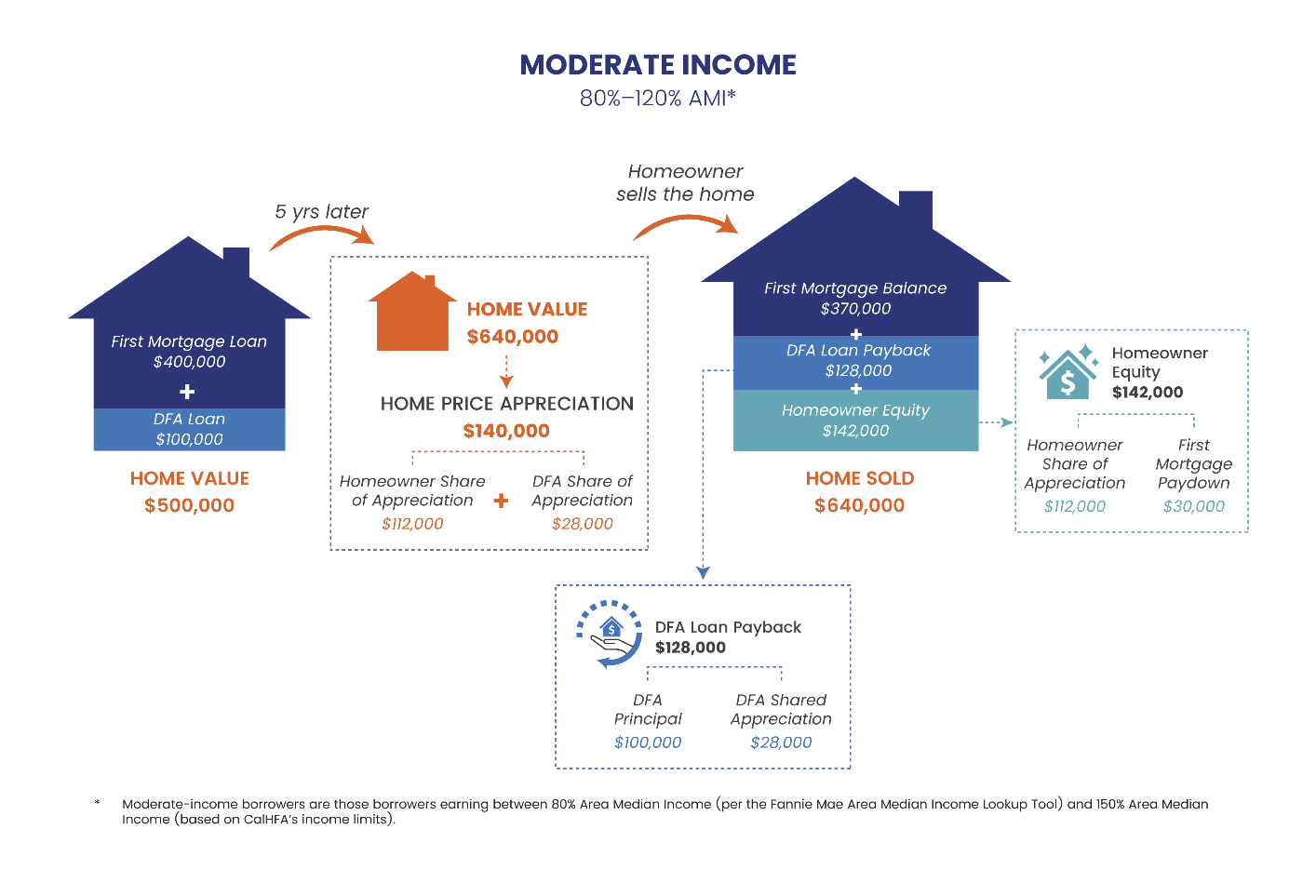

Shared Appreciation:

Let’s delve into shared appreciation, a unique aspect of the California Dream for All program. Shared appreciation is a way to give back to the community and support future homebuyers. Essentially, it means that when you sell or refinance your home, a portion of the appreciation is shared with the program. This allows them to assist more first-time homebuyers down the line.

Max Contribution and Mortgage Insurance:

Your own contribution towards the down payment is capped at 5%. If your first mortgage exceeds 80% LTV, be prepared to pay for Mortgage Insurance. It’s a small price to pay for getting your foot in the homeownership door.

Verify your mortgage eligibility (Jul 27th, 2024)

Homebuyer Requirements for California Dream for All:

To qualify for the California Dream for All program, all homebuyers must be first-time homebuyers, and at least one homebuyer must be a first-generation. But what do these terms mean? A first-generation homebuyer is someone whose parents or legal guardians have never owned a home during their lifetime. A first-time homeowner is an individual who has not owned a principal residence in the past three years.

Additionally, ensure your income does not exceed the program’s limits, and be ready for impounds regardless of your LTV. Remember that the maximum contribution from your funds towards the down payment is 5%.

Verify your mortgage eligibility (Jul 27th, 2024)

In conclusion, this program is a fantastic opportunity for first-time homebuyers, but it’s crucial to adhere to the guidelines throughout the process. While the voucher is your golden ticket, it doesn’t guarantee qualification – it’s up to you to meet the requirements and make your homeownership dream a reality.

So, future homeowners, seize the opportunity, embark on this exciting journey, and let the California Dream for All Conventional First program guide you to the keys of your home sweet home!