Upfront Fees on High Balance and Second Homes will Increase in 2022

The Federal Housing Finance Agency announced that they will be increasing the upfront fees for certain high balance and second home loans. Loans in affordable housing programs (HomeReady, Home Possible, HFA Preferred and HFA Advantage) will not be subject to new fees.

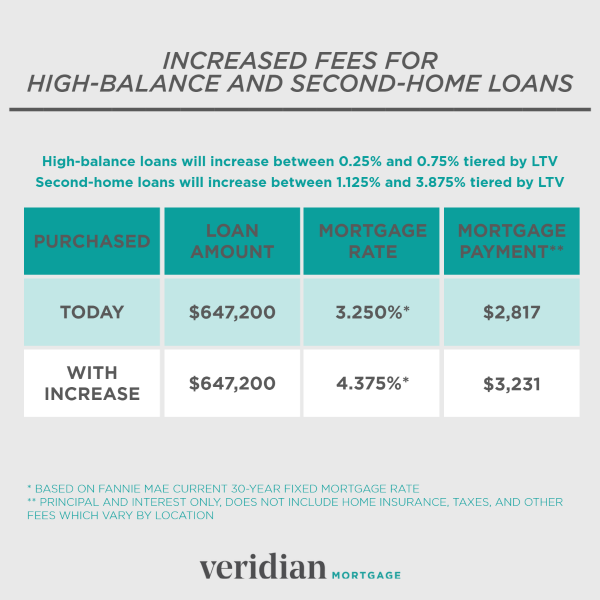

Verify your mortgage eligibility (Oct 22nd, 2024)Upfront fees for high balance loans will increase between 0.25% and 0.75%, tiered by LTV ratio. For second home loans, the upfront fee will increase between 1.125% and 3.875% also tiered by LTV ratio.

The new fees will go into effect beginning April 1, 2022.

Here is an example of what the increase would look like for a $809,000 purchase price with 20% down.

.png?format=1000w)

If you are looking to get pre-approved, click here to get started.