The Secret to Finding the Best Mortgage: Retail vs. Wholesale Lenders

When shopping for a mortgage, you might come across two terms: retail lending and wholesale lending. Understanding the differences can help you make a better decision when choosing a loan.

Retail Lending (Direct to Lender)

In retail lending, you work directly with a bank or credit union to get your loan. The lender handles everything from the application to closing.

- Limited Choices: You can only choose from that lender’s loan products.

- Potentially Higher Rates: Retail lenders may have higher interest rates compared to brokers.

- Direct Communication: You deal directly with the lender throughout the process.

Wholesale Lending (Through a Broker)

Wholesale lending happens behind the scenes. Instead of going directly to a lender, you work with a mortgage broker who shops around for the best loan from different wholesale lenders.

Verify your mortgage eligibility (Mar 7th, 2026)- More Loan Options: Brokers have access to multiple lenders, offering you more choices.

- Lower Rates: Wholesale lenders typically offer brokers better rates, which can result in savings for you.

- Personalized Service: Brokers work on your behalf, finding the best deal and guiding you through the process.

Why Wholesale Lending is Often Better

- Better Rates: Wholesale lenders offer lower rates because brokers handle much of the work.

- More Flexibility: Brokers can match you with the best loan for your specific needs, from a wide variety of lenders.

- Simplicity: Your broker does the heavy lifting, simplifying your search for the best mortgage.

DID YOU KNOW?

Research shows that shopping around for mortgage rates can lead to significant savings. Just one extra quote can save homebuyers an average of $1,500, while comparing five quotes can result in about $3,000 in savings! A recent study found that consumers who explore their options through a mortgage broker save an average of $10,662 over the life of the loan. Since brokers have access to multiple lenders, they can help you find competitive rates and loan options tailored to your needs.

[source: Freddie Mac; Polygon Research]

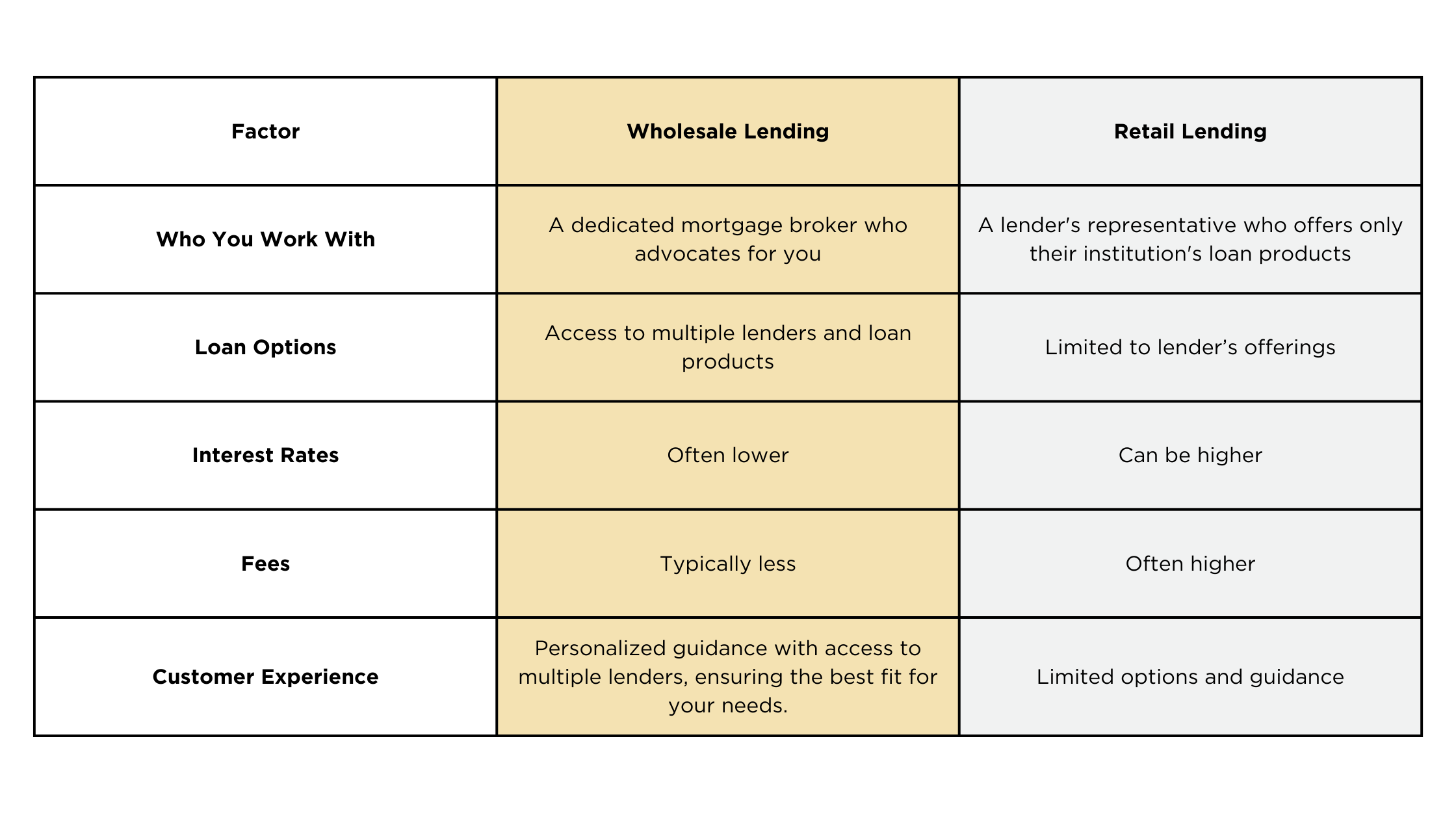

Key Differences: Retail vs. Wholesale Lending

Which Should You Choose?

If you want more options, the opportunity to shop rates with one application, and a personalized approach, wholesale lending through a broker is often the better choice. Brokers can save you time, money, and the hassle of shopping around on your own.

Show me today's rates (Mar 7th, 2026)